Convincing Features

Assignment Type

Subject

Uploaded by Malaysia Assignment Help

Date

QUESTIONS:

Note: If you press √ means that the reciprocal of power 2 (^2). In this calculation, it refers to power 10@ ^ 10, therefore 10√

From calculator, you press 10 then SHIFT then ^..10 x√ 1.4106

FV = PV (1 + r) t – annually

FV = PV (1 + r/2) tx2 – semiannually

c = annual interest cost

N = total number of payments

P = principal of the loan

Coupon Payment = CR% x Par value

Current Yield (%) = Coupon Payment

Value or Price of Bond

(4 marks)

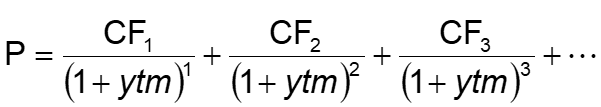

YTM = CP + (PV – Vb)/n

(PV + Vb)/2

(2 marks)

(4 marks)

(2 marks)

(4 marks)

(2 marks)

(4 marks)

(2 marks)

Step 1 Find the coupon payment

YTM (%) = Coupon Payment+ (Par Value – Bond Price)/ t

(Par Value + Bond Price)/2

Step 2 : Find the bond current yield

Current Yield (%) = Coupon Payment

Value or Price of Bond

(2 marks)

Interest = principal ´ rate ´ term (n)

If you are thinking about hire a best assignment helper malaysia for this FFN20303: Money and Capital Market Assignment task. then you are right. our writer has many years experience to providing assignment solution. we cover all various of assignments like essay help, report help, case study help, etc.