Convincing Features

Assignment Type

Subject

Uploaded by Malaysia Assignment Help

Date

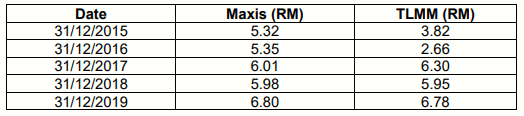

1. (a) Mr Shahrul Affendy had been appointed to lead the finance team of Extreme Broadband Corporation. The team is required to advise the board on the investment that should be undertaken. The annual historical share prices for Maxis and Telekom Malaysia Berhad (TLMM) are as follows:

As the leader of the finance team, he is required to suggest the preferable

company to be invested based on the coefficient of variation for Maxis and

Telekom Malaysia Berhad (TLMM).

(b) Azimah works as an investment analyst for Permodalan Nasional Berhad

(PNB). Currently, she is evaluating five shares and has to report to her

manager on the performance of the shares. Below is the respective

information on the shares.

i. Expected return on the portfolio.

ii. Required rate of return for this portfolio.

2. Armani Berhad and Ardeena Berhad are identical in every respect except that Armani Berhad is unlevered while Ardeena Berhad has RM2,000,000 of 5 per cent debt outstanding. Assume that all the Modigliani and Miller assumptions are met, the Earnings Before Interest and Tax (EBIT) is RM1,500,000 and the cost of equity to Armani Berhad is 18 per cent. The corporate tax rate is 38 per cent. Determine the Weighted Average Cost of Capital (WACC) for both propositions.

Malaysia Assignment Help has a huge team of professional writers who provide guidance to Kuala Lumpur university students. our experts are well educated to offer finance assignments at a nominal price.